If you are new to the world of grant writing or research or simply want to learn how to streamline your approach and find funding suited to your goals more efficiently, this article is for you. If you are looking at private foundations for grants, you MUST know how to research their grant giving history. The way to do this is by reviewing their Federal 990 Tax Forms. With this information, you will be able to quickly scan 990 information and documents for what you need and filter funding opportunities effectively.

What’s a 990 Form?

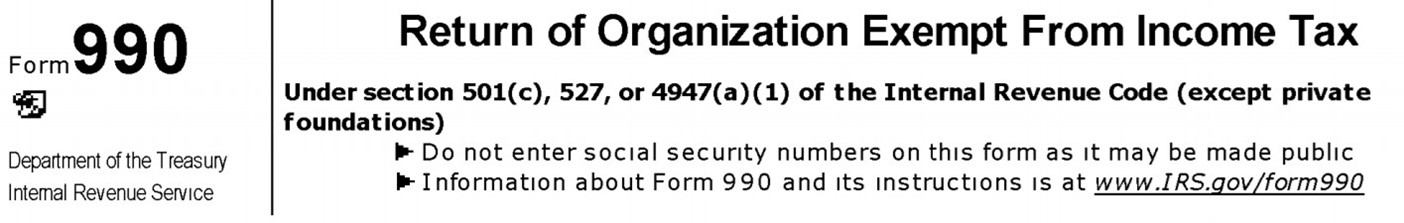

In the United States, tax-exempt organizations, non-exempt charitable trusts, and section 527 political agencies are required to file a 990 tax form to the Internal Revenue Service annually. When searching private foundations and trusts, these may be the only IRS document filed showing gains, losses, and contributions in the previous years.

Discover Grant Writing as a Career

If you’re interested in becoming a grant writing consultant, check out this free training on how you can pull off a meaningful career change.

Access Free Class

What You Can Learn From Reviewing 990 Forms

There are a few ways you can put these IRS forms to good use - any one of which can absolutely be worth their weight in gold! It’s important to confirm whether a funding agency is likely to fund your request by looking at their giving history.

We like to ask ourselves these questions when reviewing a 990:

Why Were Awards Granted?

A foundation’s website sometimes uses language that makes it seem like they award grants to a number of different priority areas, such as environmental projects, health care, youth organizations, and the arts. However, you may find (thanks to looking at their 990!) that this funder only makes awards to youth organizations. If your project is related to the environment, you now know not to bother applying, despite how good of a fit it looked like from the outside.

What Amount Was Awarded and When Were Awards Made?

The second and third most important questions to answer is whether this funder has made awards recently and in amounts that suit your needs.

We often find that an organization shows annual awards are made but when we check their 990s, it shows the information is out-of-date.

You may also find that the amounts are so small, they aren’t worth your time approaching. If you need a large sum now but the funder’s 990 shows that their median award is $1,000, this is probably not the right program for you at this time. That doesn’t mean it won’t be in the future, it just helps you to sort through all of the funding opportunities out there efficiently.

Who Received Awards?

Another helpful item we can learn from 990 forms is whether a funding agency is awarding grants to the same organizations year after year. While their website may claim to make 40 awards annually, if half of those are to the same people year after year, your chance of getting that award is much slimmer.

Free Grant Writing Class

Learn the 7-steps to write a winning grant application and amplify the impact you have on your community.

Access Free Class

How to Win a Grant

Okay, there isn’t a formula to follow that guarantees a winning grant. There is a way to calculate your chances of success and the grant’s competitiveness. At Learn Grant Writing, we teach this easy formula for identifying your likelihood of being awarded a grant. This calculation utilizes figures from the previous funding cycle to estimate the percent of applications that are successful. Many seasoned grant writers know how frustrating it is to put intense time and energy into a project, only to find out your proposal was denied. By doing a small amount of research in the beginning by contacting the funding agency, you can save yourself a lot of time and disappointment.

First, you will need to obtain the number of proposals received during the previous award cycle and the total number of grants awarded. To make it simple, let’s say the organization received 100 applications for funding the previous cycle and made 20 awards. To calculate the chances of success, we divide the number of grants awarded by the number of applicants. 20 awards ÷ 100 applications = .20. Therefore, there is a 20% chance an application submitted will be awarded.

Prioritize grants with at least a 20% possibility of success.

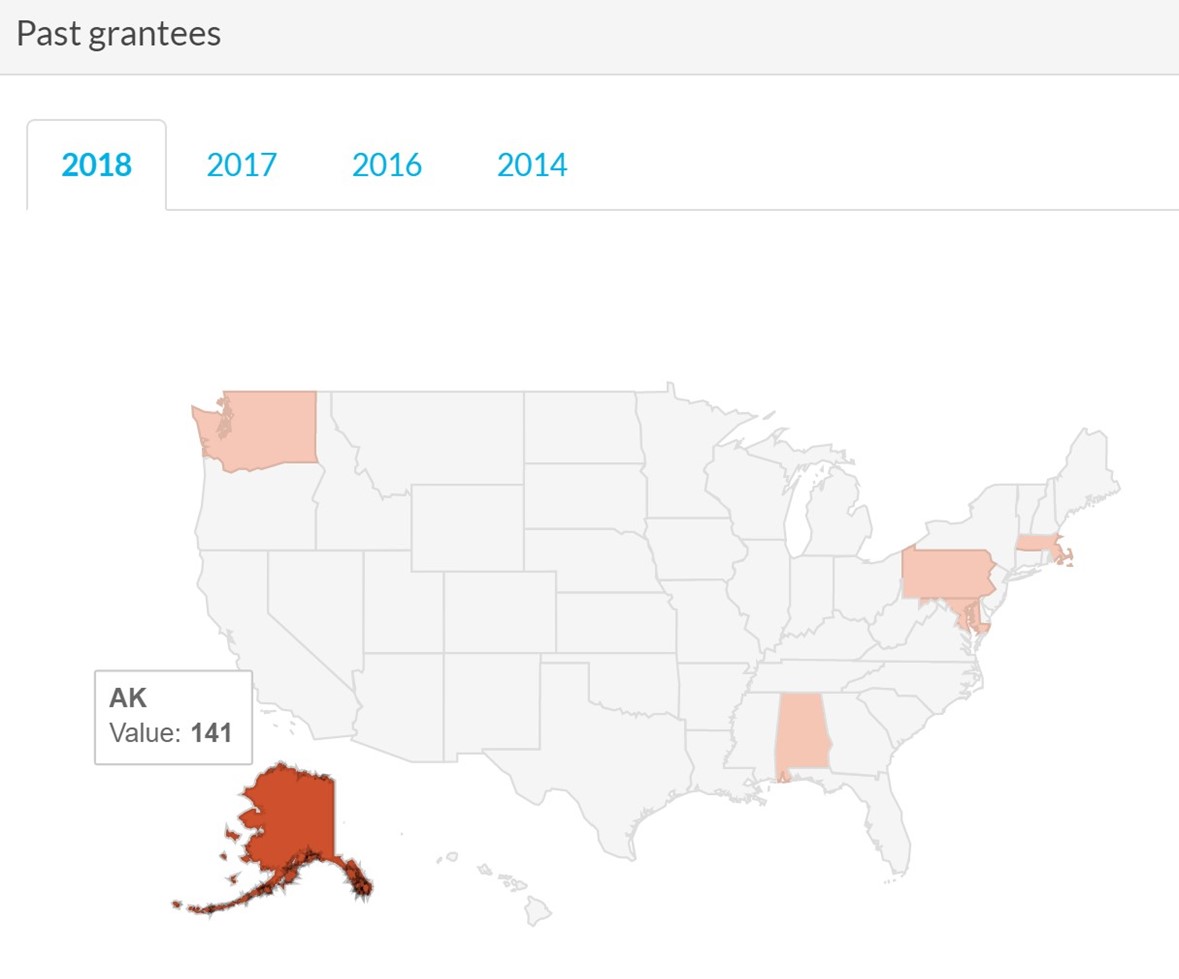

Where Were Funds Awarded?

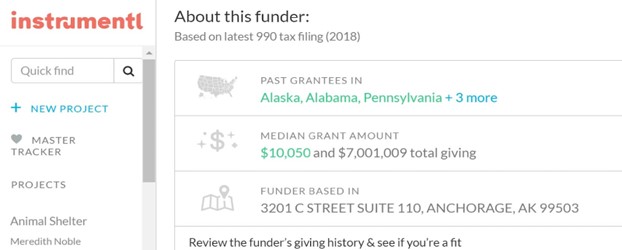

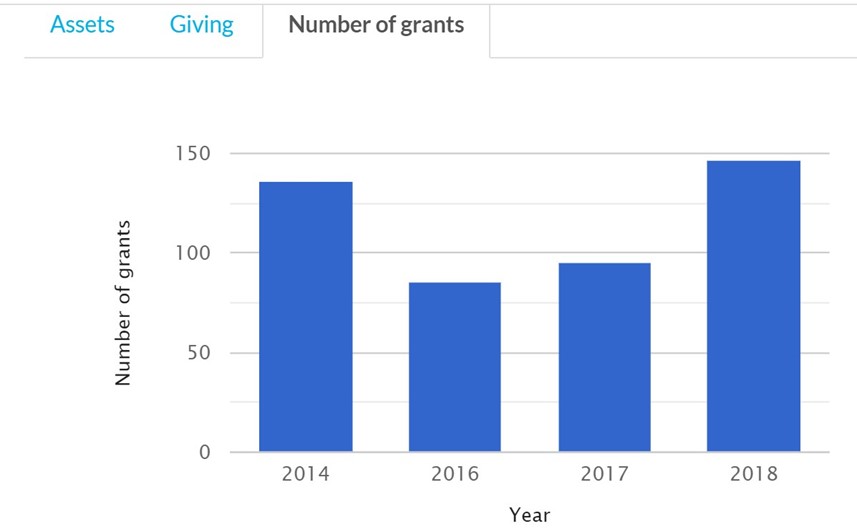

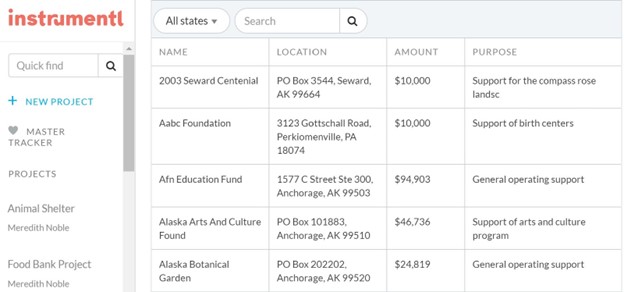

This question looks mostly at the specific city, state, or region an agency awards grants. It also tells you where the grantee is located or based. One of our favorite grant databases, Instrumentl provides an easy-to-use 990 reader with a map view. This is by-far the fastest way of eliminating a funding opportunity. The announcement may say they fund anywhere in the US, but you may find only organizations located in New York and Massachusetts have ever received awards. Once again, you can quickly set this funding agency aside and move on to the next.

Looking at the location of past awards may also work in your favor. Sometimes, we may find funding organizations that ONLY award to the region we are based. If that information wasn’t immediately available or obvious, that means many organizations may be submitting applications that will never qualify for that funding.

The bottom line is to focus on grants that are awarded in your general geographic area. Another Learn Grant Writing idiom is that the best indication of future giving is past giving!

The best indication of future giving is past giving.

Past Awardees

Since the 990 form specifies who received grants, you can use that information to your advantage. We suggest reaching out to successful grantees for feedback on their project and what it was like to work with that funding agency. If it makes sense to do so, you may even ask them for a copy of their successful application to reference moving forward. We have found that many agencies are out to make the world a better place and some are happy to help a fellow changemaker, especially if they are not competing for the same funds.

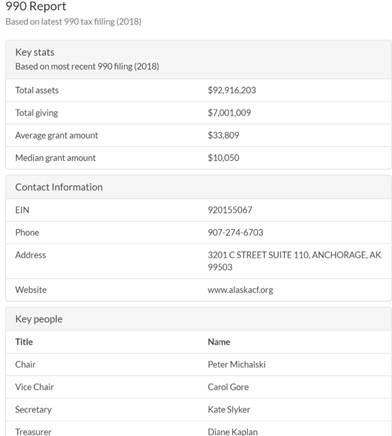

Board of Directors

Another valuable piece of information these 990s hold is the funding agency’s Board of Directors list and/or Executive information. While this may be something available on the organization’s website, the most recent 990 will contain the most up-to-date names and contact information.

We find the Board of Directors list useful in determining if someone in your organization has an existing relationship with a member of the funder’s Board. This may put your organization in a strategic position to request feedback on whether or not your proposal is a good fit with their funding priorities. In our program, the Global Grant Writers Collective™, we encourage grant writers to make connections with each funding agency to determine compatibility and gain feedback on a project or proposal before applying. If a relationship with a member of the funder’s Board of Directors is already established, it will save you a fair amount of time in research.

990 forms offer a snapshot of this information in one place and most databases will have the prior five to ten years on file. Don’t know where to start? That’s okay. Keep reading.

Find Information You Need in a 990

First you need to locate the 990 forms for the desired organization. Our absolute favorite place to check out funder information is Instrumentl. This site has taken thousands of these complicated tax forms and given subscribers a simple breakdown of the information relevant to grant seekers.

Instrumentl has a number of

wonderful tools you can utilize to access 990 information. The following screenshots show how you can easily scroll

through back years of these forms, along with simplified views of available funding opportunities.

At Learn Grant Writing we use this site for grant research constantly and love the format and extensive database.

If you are simply looking for an organization’s 990 forms, there are some databases out there that offer views of charitable organizations’ 990s for recent years. We recommend Foundation Center’s 990 Finder, by Candid. This site is free and easy to use, although it only offers the actual documents filed with the IRS, which may be 50+ pages to sift through. If you follow these guidelines, you won’t be frustrated by lengthy paperwork when faced with a complete 990.

By now you are probably wondering what you should be looking for when you finally dive into these forms. Not to worry! We will show you where to scroll for both paper and electronic filing documents (yes, they are different for some reason).

By The Numbers

Now we will focus on helping you find what you are looking for within those 990 forms- paper and electronic filing methods- so you can breeze through and obtain the data needed to make informed decisions regarding grant applications. This section will help you answer the why, what, when, who, and where for organizations required to submit these annually.

First, let’s focus on verifying that the organization in question actually makes contributions regularly and whether they award enough funds to be sufficient for your needs.

Paper Filing

On page one, there is an Expenses section. Line 25: Contributions gifts, grants paid will represent all funds distributed by the organization to other organizations, government entities, or individuals for various purposes during the year. Column A will represent all contributions, while column D is the total of grants and other charitable, cash-based activity.

![7-990-25-paper-filing]()

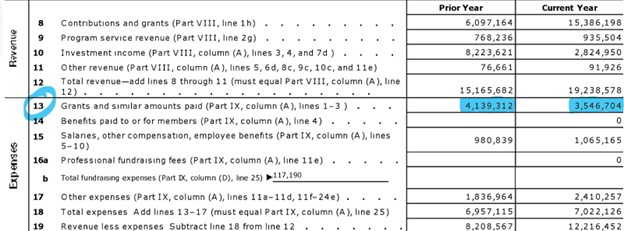

Electronic Filing

While the purpose of Part I: Summary is the same as it’s paper-filed counterpart, the placement and layout is different for each version. The total contributions for the current and previous year are listed in Line 13: Grants and Similar amounts paid on an e-filed 990. Be sure not to confuse grants received (Revenue) with those awarded (Expenses).

![8-990-electronic-filing]()

This total should be greater than zero and large enough for your funding needs.

Next you will want to identify how much of the total contributions and grants listed has been dedicated for future years. While this is not a common occurrence to see on these forms, occasionally a grant program will run on a multi-year cycle. Finding how much funding is obligated for future payments will help you to calculate the actual contributions awarded during the current year.

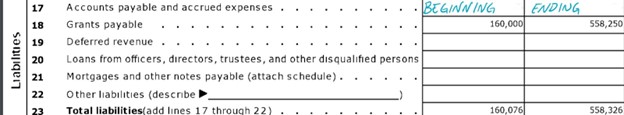

Paper-Filed

On a paper-filed 990, you will first locate the Liabilities section of Part II. Line 18: Grants Payable will represent that which is approved for future use. Column A is the total from last year and Column B is the ending total of awards dedicated for future payments.

![9-990-grants-payable-paper-filed]()

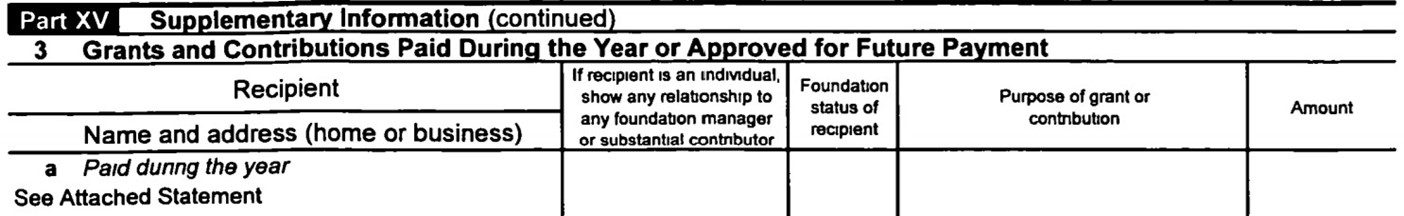

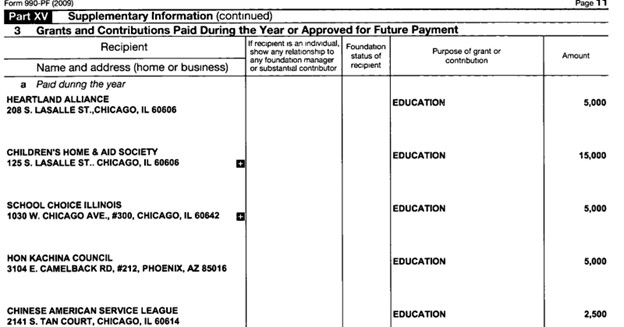

Once you have located this total and still find the current year’s contributions sufficient for your needs, you can move on to find out more information about the actual grantees. We recommend scrolling down to Part XV: Supplementary Information, Line 3: Grants & Contributions.

![10-990-grants-and-contributions]()

This part will help to verify totals from this year and that approved for the future. While a list of grantees can sometimes be found here, it is more often a note is present sending the reader to an attachment at the end of the 990 (see above).

Column (A) is equal to columns (B, C, &, D) combined.

At this point you will be looking closely at the individual grants made. To answer some of those ‘W’ questions, we like to begin by searching for awards made to organizations in our region and for amounts that are suitable to our needs. If the funding opportunity states the grant ceiling is $50,000 but never makes awards over $5,000, you may find this program will not work for you.

Paper-Filed

In these 990s, you will find the grantees listed in Part XV: Grants & Contributions Paid. If the list is too long for the form, you will find a notice to see the attached grantee information at the end of the 990.

![13-990-list-of-grants]()

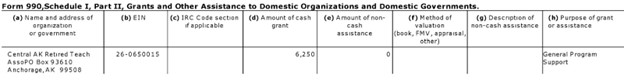

E-Filed

With the electronic version, 990 grantee information will be listed in separate schedules based on the nature of the grant. Contributions made to foreign entities will be listed on Schedule F: Statement of Activities Outside US, Part II: Activities per Region, Line 1.

For everything made to US entities, you will need to locate Schedule I. Part II: Grants Inside the US, Line 1, will contain award information regarding US government agencies and organizations. Part III, Line 1, lists Grants to Individuals in the US. Once again, you may need to continue to the end of the 990 to find an attachment if there is too much information for the space given.![14-990-schedule-1-part-2]()

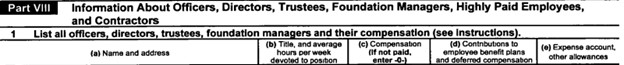

As you make your way down the 990, you will come to information specific to Officers, Directors, Trustees, Managers, etc. As we discussed earlier, having an ‘in’ with a board member or executive of the funding organization will allow you to access a little more in-depth information and ensure your priorities are in alignment.

Paper-Filed

This will be located in Part VIII, Line 1, Columns a-e. You may find that the information can be found on a separate attachment at the end of the form. The section will contain the most up-to-date names and contact information, compensation, time, contributions, expenses, and allowances which should be updated annually. We always recommend checking with your organization and possible funders to identify existing relationships that can be utilized.

![15-990-board-of-directors]()

E-Filed

Finally, with the electronically-filed format, information regarding Directors, Officers, Trustees, Managers, etc., can be located on Part VII, Section A.

![16-990-board-of-directors-electronic-filing]()

Discover Grant Writing as a Career

If you’re interested in becoming a grant writing consultant, check out this free training on how you can pull off a meaningful career change.

Access Free Class

Final Takeaway

Searching through 990s can feel cumbersome, but there is a wealth of information in the form. Save this post and reference for later when you need to do a deep dive into a funder.

At Learn Grant Writing, we have taken years of combined knowledge and hard-learned lessons and boiled it down into something concise and meaningful so you can jump right into building your dream lifestyle made possible by grant writing.

Resources

Keep reading our blog articles. Specifically, this one is all about match funding and where to find it.

Also, check out our FREE Class on Writing Grants in just 7 easy steps!

More questions about the Collective? You can send us an email at [email protected].

Or, shoot us a DM on Instagram!